Any long-term financial investor or speculator understands how volatile and lucrative Bitcoin has been over the years. From a humble cryptocurrency that was valued less than $1 in 2011 to rising to an all-time high of $63,000 by the end of the first quarter of 2021. Bitcoin’s appeal lies in its long-term potential and popularity, and that is also its biggest disadvantage.

Why Did Bitcoin Crash on the 12th of May 2021

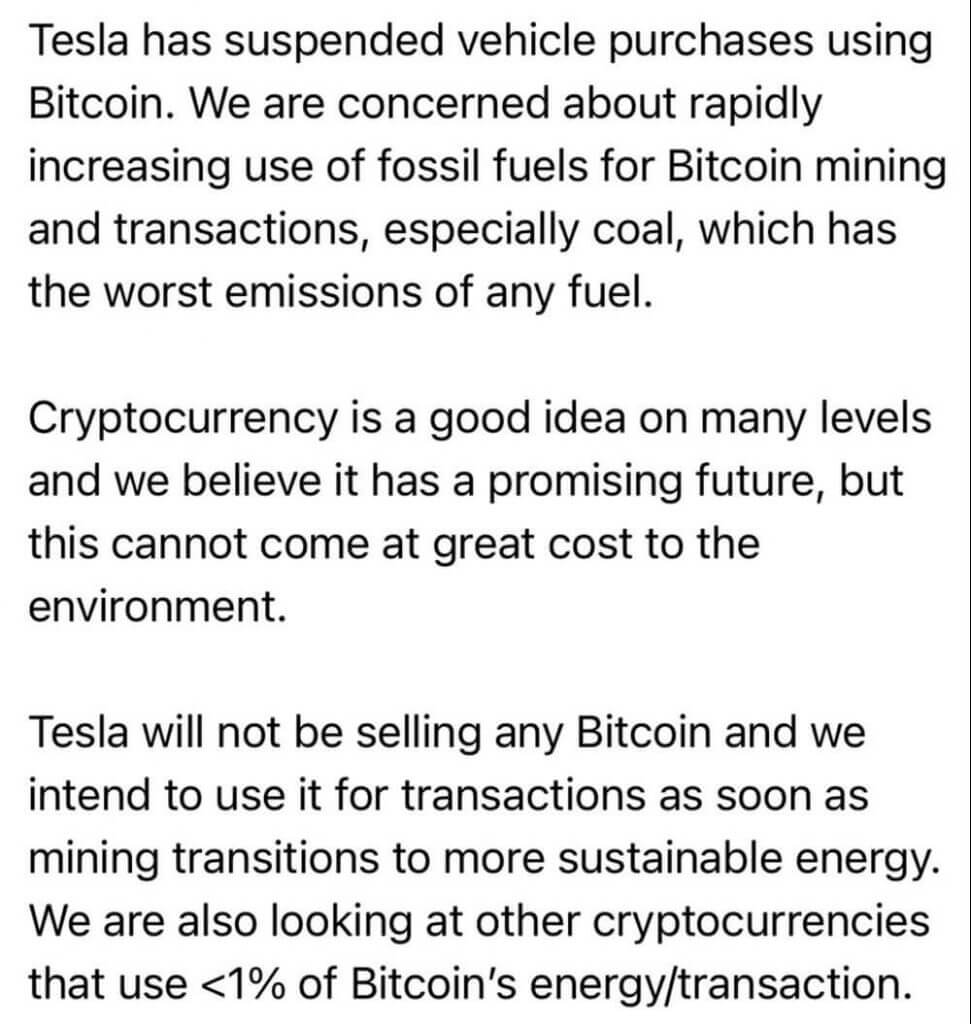

Elon Musk, on Wednesday 12, 2021, released a tweet that Tesla no longer had plans to accept Bitcoin as payment for their products.

This announcement went against another decision Tesla made earlier in February after investing over $1.5b in Bitcoin then. Along with billions of dollars in investment, Tesla announced that it would begin accepting digital currencies as payment for Tesla Vehicles.

His recent announcement to stop accepting BTC as payment method sent the cryptocurrency market into a decidedly bullish downturn, as millions of speculators sold their coins.

Bitcoin tumbled down from a stable $54,000 to $46,000 overnight, and Ethereum and every other major cryptocurrency experienced double-digit losses. By the end of the push, the market nearly shed $365 billion of value and left investors in question as to why.

Musk said that his decision was prompted by Bitcoin growing environmental concerns. Bitcoin is reported to consume 130 Terawatts in a year, which is 0.6% of the world’s electricity consumption.

Musk further went on to explain that the decision had less to do with electricity consumption itself and more to do with how much of it was sourced from fossil fuels like coal which had the worst emission of any fuel source.

Elon Musk’s concerns were valid. After all, Tesla as a company is pro-green energy, and its ultimate goal is to replace fossil fuel cars. Through the crisis, Tesla still dutifully held onto its substantial Bitcoin portfolio which was valued at $1.5 Billion by March.

The Problem of Bitcoin as a Currency?

Bitcoin has been identified by economists and financial experts as a speculative currency that is too volatile for any real or practical use. Several times throughout the past decade or so of Bitcoin’s existence, it has suffered major volatile shifts which wiped out millions of investors, and enriched others.

From January to February 2018, the price of Bitcoin fell by 65% and set off a major decline in the crypto space that dragged down the market for years. In 2021, the same pattern might be repeating itself.

Financial institutions, fortune 500 companies, and governments are all buying into the idea of cryptocurrencies, all in a race to control the market before digital currencies finally catch on. But before they do, they will remain as an intangible asset class for speculative high-risk investments.

All that attention is placing unprecedented pressure on the currency that started it all, Bitcoin. And this is a greater problem because, unlike some stable, or altcoins that have some sort of physical backing, bitcoin is still very much intangible in every sense of the word. The coin is still in its very early stages of integration into our economy. Most people can’t spend the bitcoin they’re holding onto, and Tesla’s decision to pull support affirmed the doubts that thousands of experts have pointed out before.

Bitcoins are too volatile, and non-liquid to serve as a fiat currency

One of the main reasons why Bitcoin and crypto, in general, remain as volatile as they are is because of how risky they all are as asset classes.

They are separate entities, largely disconnected from our modern economy, and large wipeouts, crashes, pumps, in some ways are isolated to just the crypto world and don’t have far-reaching, paradigm shifting consequences. The general public doesn’t trust it, so most investors are not satisfied to just invest and hold. Big news like Tesla putting support test the fragile faith long-term investors have in bitcoin, and a set of beginners, and traders.

Bitcoin and most cryptocurrencies stand the very real risk of crashing because of the increased attention, and lack of economic support. Until Bitcoin becomes fiat, it might function as nothing but a speculative battlefield for most investors.